Online shopping has definitely become more popular in the Philippines, but online scams – from fake sellers to bogus buyers – are ruining the experience for many Filipinos.

To further boost the growth of e-commerce in the Philippines and protect customers from online scams, PayMaya introduced PayMaya Verified Sellers, a feature that makes transactions safer for both buyers and sellers using the PayMaya app.

With this another first-in-the-market and unique feature, PayMaya is equipping online sellers who utilize the e-wallet to accept payments with a special badge – making it easier for consumers to check if they are paying legitimate businesses on the app.

By registering as a PayMaya Verified Seller, small business owners and people with side hustles can get instant credibility through a verified badge that customers can see, marking the account as “legit.”

To get this special badge, PayMaya Verified Sellers will undergo another layer of screening to ensure that they are legitimate online businesses and are on good standing, on top of the standard registration and upgrade process for PayMaya app users. For sellers, this badge from PayMaya is a stamp of approval – a way to let consumers know that they are legitimate and trustworthy businesses that have passed the financial institution’s rigorous background check.

Once verified, the badge will appear beside the seller’s account name, which the customers can easily spot right before they transfer their payments in-app.

“For digital transactions, trust is key. That’s why we have created this unique feature for the millions of PayMaya users who are utilizing the app as sellers and buyers. Through PayMaya Verified Seller, we aim to make our ecosystem safer from online scams. We encourage all online sellers to get verified with PayMaya so you can show your customers that you are ‘legit,'” said Pepe Torres, Chief Marketing Officer at PayMaya.

Aside from giving customers an added layer of protection, PayMaya is equipping sellers with tools to help protect them from bogus buyers.

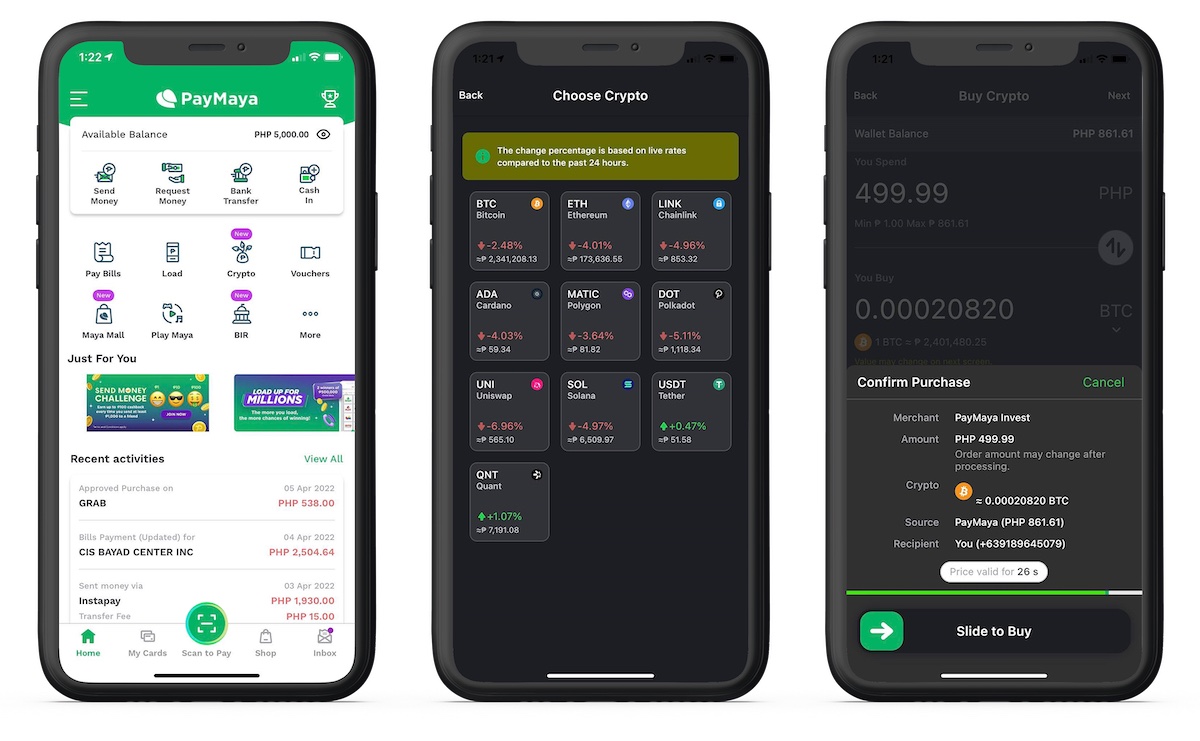

By utilizing PayMaya as a payment method, sellers can track their transaction history in real-time – allowing them to check instantly once a buyer transfers the payment. PayMaya is the only e-wallet offering this feature, addressing seller issues like fake transaction receipt screenshots from bogus buyers.

Being a PayMaya Verified Seller gives access to features that can boost business too. Here are just some of the added perks that online sellers should not miss:

- Accept payments from anyone in any way. PayMaya enables sellers to accept payments from all customers seamlessly – whether they are PayMaya users via QR, Send Money, or Request Money; bank account holders via QR PH and Instapay transfers; and even those without any financial account via Smart Padala to PayMaya money transfers.

- Reach millions of potential customers. As a PayMaya Verified Seller, you will be featured in PayMaya’s social media channels and in-app Maya Mall so you can reach millions of PayMaya users to help boost your business.

- Increase your account limit to P1,000,000. Once you are ready to expand your business, PayMaya will also be prepared to support you with an increased account limit – allowing you to grow their business even further.

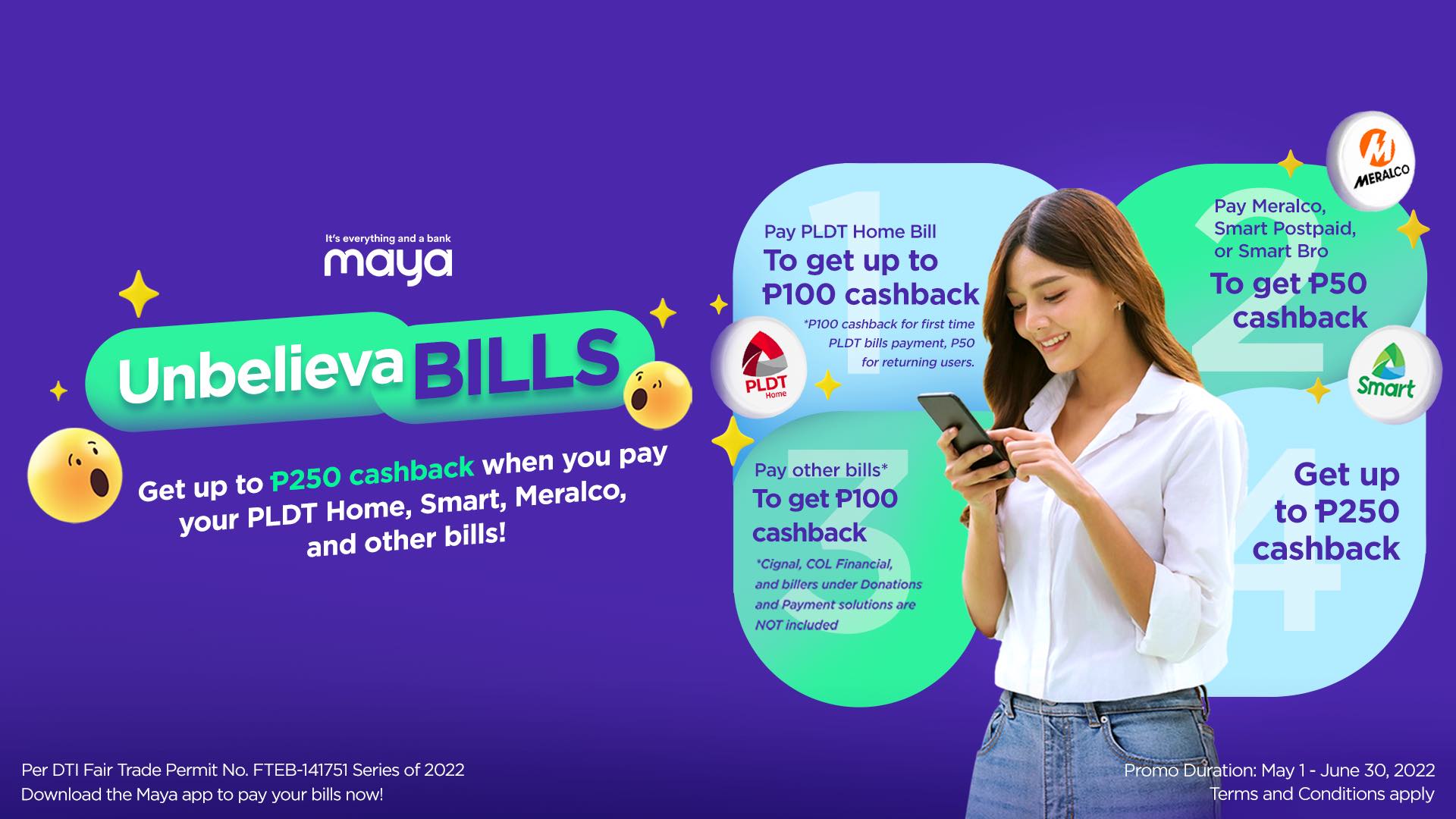

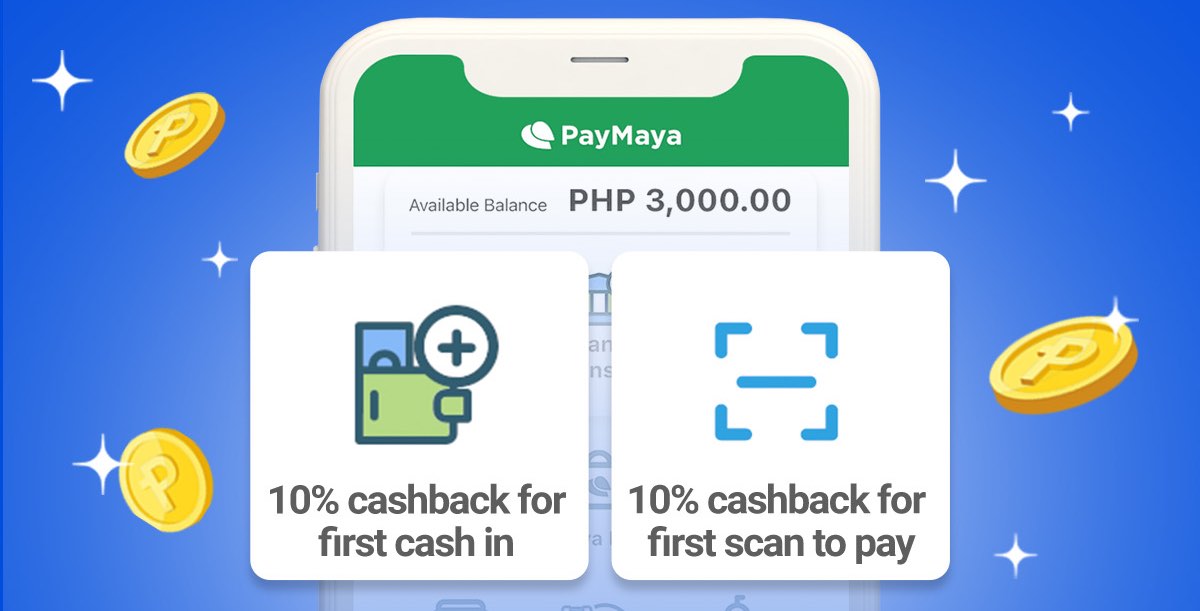

- Get exclusive perks to make the most out of your earnings. You can enjoy exclusive discounts on bills, groceries, deliveries, and waived bank transfers by simply using their PayMaya app for their everyday transactions.

With PayMaya’s 99.9% uptime rate, online sellers and buyers can be confident that transactions will go through, especially when they need it most. This high uptime rate and enhanced features have translated to a more reliable and smooth customer experience, making PayMaya the top-rated e-wallet in the Philippines for both Google Play and App Store.

Signing up to be a PayMaya Verified Seller is fast and easy—business owners simply need to fill out the online form at https://www.paymaya.com/survey/verified-seller. Sellers can be verified within five business days.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, communities, and government. It provides more than 41 million Filipinos access to financial services through its consumer platforms. Customers can conveniently pay, add money, cash out or remit through its over 380,000 digital touchpoints nationwide.

Its Smart Padala by PayMaya network of over 60,000 partner agent touchpoints serves as last-mile digital financial hubs in communities, providing the unbanked and underserved access to digital services. Through its enterprise business, it is the largest digital payments processor for key industries in the country, including “every day” merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.

To know more about PayMaya’s products and services, visit www.PayMaya.com or follow @PayMayaOfficial on Facebook, Twitter, and Instagram. For more information on Smart Padala, visit https://smartpadala.ph/.